How to Prepare for the CFA is your main goal. However, many candidates struggle to use their time effectively for studying. It would help if you have a well-structured plan to reach that goal.

In this article, you’ll learn how to prepare for the CFA exam with practical tips and tricks. We’ll highlight the common mistakes of students so you can avoid them and

stay ahead of the game.

Table of contents:

- What are CFA exams?

- How much do I need to study to pass the exam?

- How to Manage Your Time for Studying?

- Tips and tricks to ace the exam.

- Common mistakes to avoid.

- Frequently Asked Questions (FAQ).

What are the Chartered Financial Analyst (CFA) exams?

The Chartered Financial Analyst (CFA) program was first introduced in 1963 by the CFA Institute. It is one of the most respected certifications in finance, having helped over 200,000 candidates worldwide achieve their career goals.

How to Prepare for the CFA Program?

If you want to complete the program then you need to go through three phases of it. Each level takes at least 300+ hours of your time. It may change depending on how students manage their study time. On average, it takes four years to complete this program. This program curriculum covers:

- Investment tools

- Portfolio management

- Wealth planning

- Asset valuation

Is the CFA Exam Really That Tough?

The difficulty level of CFA varies from level to level and can be judged by analyzing the stats.

- Level 1: 41% pass rate (Multiple-choice questions)

- Level 2: 45% pass rate (Vignette-supported multiple choice)

- Level 3: 52% pass rate (Vignette-supported essay and multiple choice)

You have to clear the first level of CFA exams to advance. Don’t be discouraged after seeing that because passion, hard work, and proper guidance for managing your time and study will help you succeed.

How Much Do I Need to Study to Pass the CFA Exam?

You have to go through the following steps if you want to prepare for the CFA exam.

First Two to Three months:

If you have a prior background in finance, then it is good, But if you don’t then the first thing you need to do is to build a solid foundation within two to three months for:

Ethics, Financial Reporting, Fixed Income, and Quantitative Methods

You should dedicate 50-60% of your study time to this section, which covers most of the exam content.

Next Two to Three months:

At this stage, you should focus on the remaining topics, as they are also essential

such as Equity and Portfolio Management,

Although these topics may not carry much weight in the first two levels, most of the exam in Level 3 comes from this section. Remember that every section is important, and no topic should be neglected.

Also at this point, you should start integrating yourself with the test. This will help you during the real exam.

During last month:

In the final month of CFA exam preparation, dedicate your time to revision, take 3-4 full-length mock exams, and focus on your weak areas.

Practice it again so that you will be able to manage your time well on the exam day.

Make sure to practice it again and again. It will make you perfect and different from others.

How to Manage Your Time for CFA Studying?

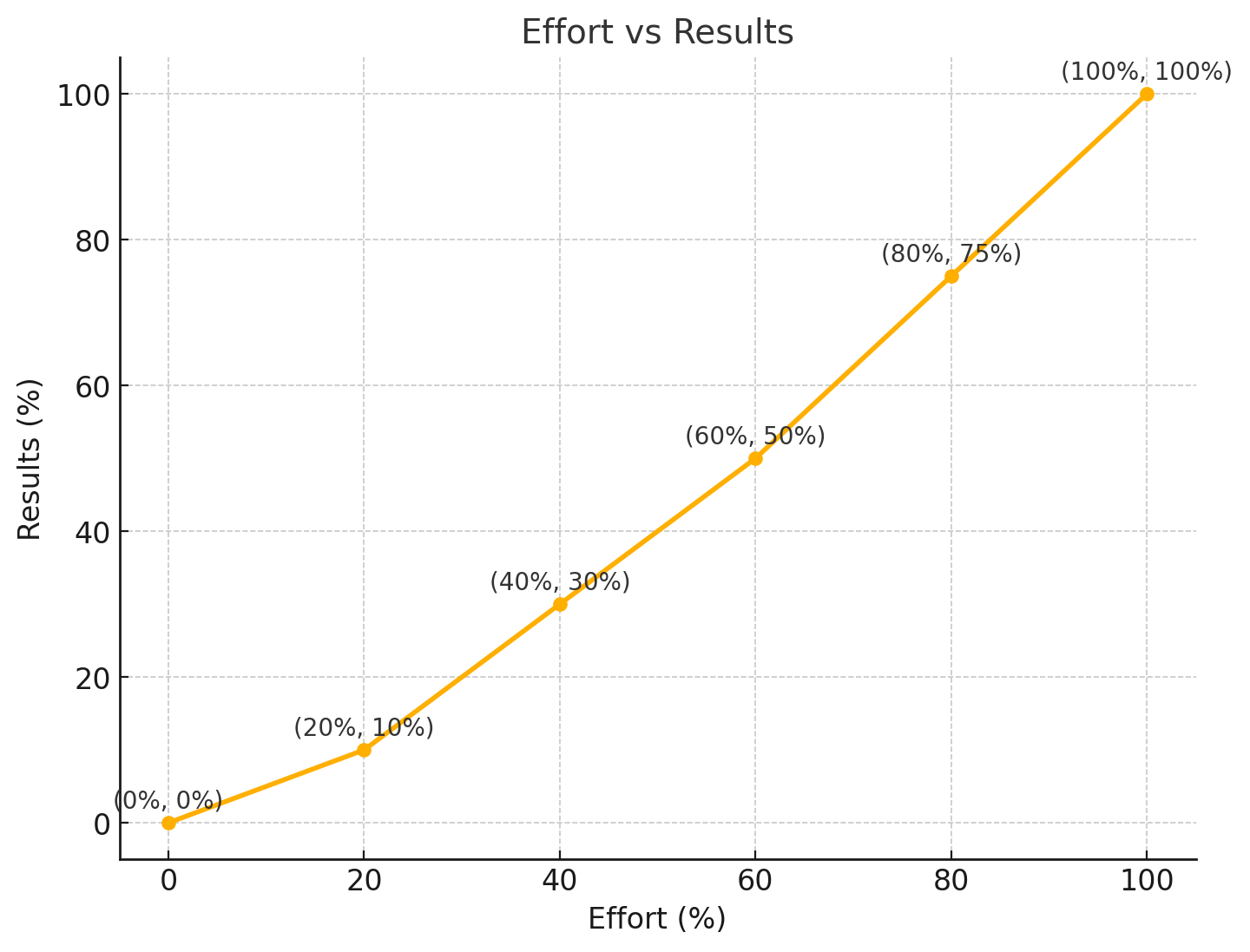

If you can manage your time properly you can avoid many problems not only in your studies but also in your life.

Prioritize Weaker Areas For CFA Preparation:

You might wonder how to manage time for CFA exam study and that is where many students stumble. They go along with the 300-hour plan and divide time equally for all subjects despite having a solid background in certain subjects.

This approach can lead to problems when the exam draws nearer. Unnecessary focus on a subject in which you already have a solid background leaves less time to focus on areas where you need improvement.

It creates unnecessary stress as the exams get closer because you would not have Properly studied all the subjects due to less time, which can lead to big problems. Instead, make a balanced plan that focuses on improving weak areas while still reviewing familiar topics.

Note: it’s not that you don’t have to study subjects you are familiar with. But focus more on those that require improvement.

Managing Time for Work and Study:

Although it’s tough to optimize time when you are working, my advice is not to leave your job. Try to dedicate some time to studying during your breaks.

If you’re having problems, Get up early in the morning and dedicate two hours to studying.

This approach is more effective because you will focus better in the morning instead of studying after a long, exhausting workday.

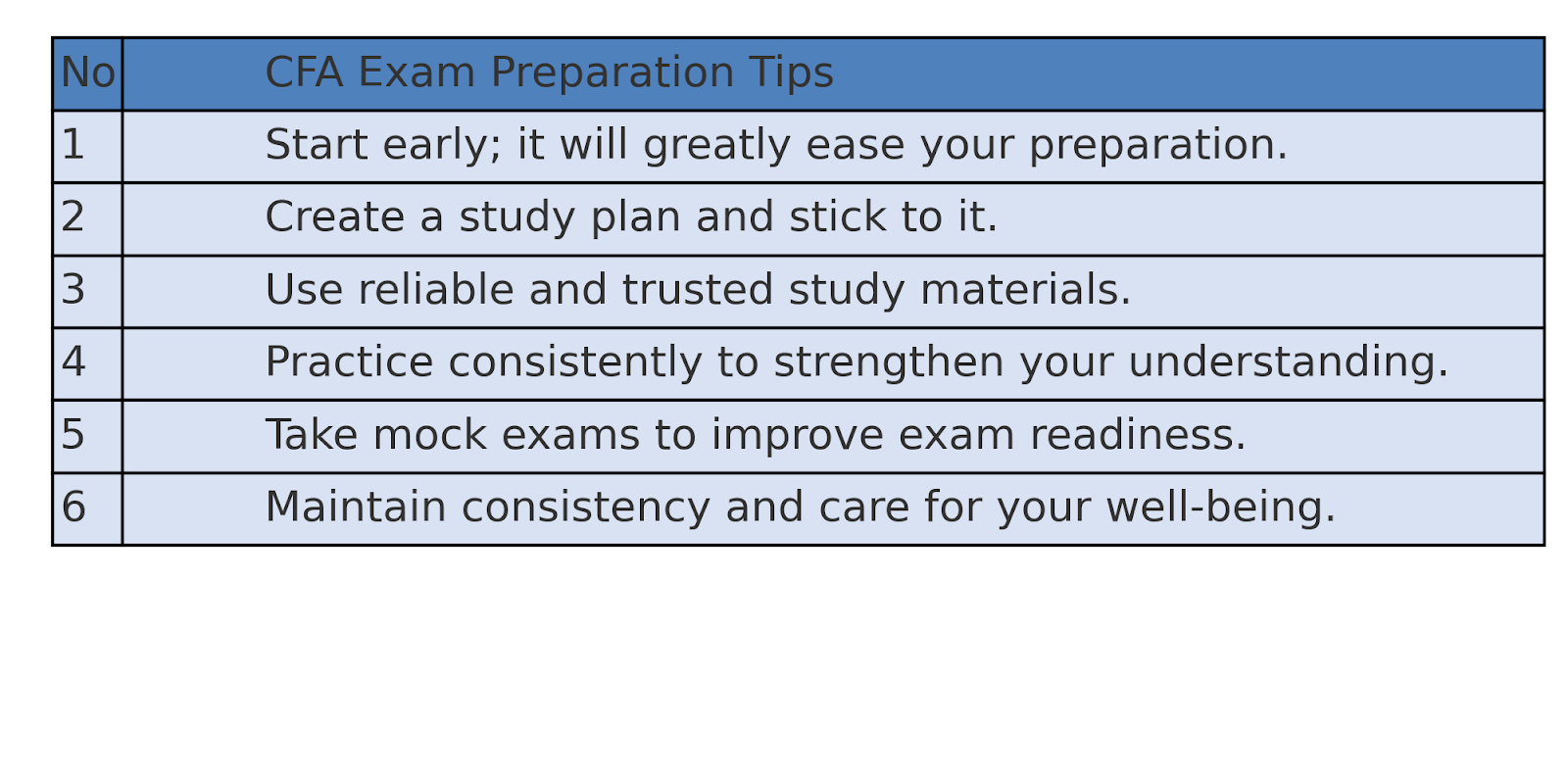

Effective Tips to Pass the CFA Exams:

Preparing for the CFA exam requires devotion and is a challenge on its own, but with the right tips and strategies, you can turn this challenge into the foundation of your career.

Start early to make your preparation easier.

Start preparing six to seven months before your CFA exam. This will help you manage your time effectively and create the best possible study plan.

This approach will help you study for each subject while still leaving time for mock exams and practice.

Create a study plan and stick with it.

If you make a study plan for the first month and change it in the next because it’s not working, doing this will create too many plans and make it hard to prepare properly.

So make one proper plan that you think is effective, try it out for 3-5 days, and see if it is comfortable for you. If you don’t feel comfortable or enjoy it, it will be hard to stay passionate about it for long.

Use reliable material and practice it thoroughly.

You should collect reliable study material to prepare for the exams and practice it thoroughly to build confidence and understand your syllabus.

Doing more practice will let you manage time properly in the exams and help in long-term learning.

Take mock exams for improvement.

Taking mock exams before taking the real one will help you understand the exam properly and let you know how to manage time in your exams.

If you believe you are prepared because you have studied all your notes but have not taken any mock tests or practiced, you might face unexpected challenges during your exam.

Common mistakes to avoid during exams.

If you can overcome common mistakes students make during exams, Then you will mostly succeed in exams. We are going to break down some common mistakes that you might make in your exam.

- Forgetting Items

- Poor Time Management

- Calculator Errors

- Studying on exam day

Forgetting Items:

If you don’t bring the essential items that are a must for the exam or use items that don’t follow the rules and regulations set by the CFA institute then it may lead to unnecessary stress or disqualification.

Such as:

CFA-approved calculator, valid ID, and exam ticket.

Poor time management:

Spending too much time on difficult questions can interrupt your time management, leaving you struggling to complete the rest of the exam.

To avoid this, plan a strategy for handling each section. How much time do you need for each question? Don’t get stuck on challenging questions, skip it and focus on the next one for better time management.

Calculator Errors:

Calculation errors are one of the most common mistakes students face during exams. A key reason for these errors is your unfamiliarity with your calculators. To prevent this, practice with your calculator before exam day.

Additionally, double-check your calculations to avoid simple input mistakes. Even a minor error can affect your score.

Studying on exam day:

Many students try to study on exam day, but this is often considered a bad habit. Overloading your brain with new information can lead to confusion and stress during the exam.

Studying too much on exam day might also cause you to forget what you’ve learned over months of preparation.

Perform your best, and avoid studying on exam day. Instead, stay relaxed and stress-free to ensure you’re prepared to succeed!

Frequently Asked Questions (FAQ)

What is the CFA designation?

The CFA (Chartered Financial Analyst) designation is a globally recognized certification that provides advanced investment analysis and portfolio management skills. An entry-level CFA holder can earn from 50,000$ to 70,000$ per annum.

What are the eligibility requirements for the CFA Program?

To be eligible for the CFA Program, candidates must have a bachelor’s degree (or be in the final year of their undergraduate studies) or have 4,000 hours of professional work experience in investment decision-making.

How do I clear the CFA exams on the first attempt?

Clearing the CFA exams on the first attempt requires a well-planned study strategy,

Focusing on core subjects and proper time management or avoiding common mistakes candidates make.

What are the most important topics to focus on for the CFA exam?

- Level I: Ethics and Professional Standards, Financial Reporting and Analysis, Quantitative Methods

- Level II: Financial Reporting and Analysis, Equity Investments, Corporate Finance, Portfolio Management

- Level III: Portfolio Management, Wealth Planning, and Fixed Income Investments. Prioritize these topics and ensure you have a deep understanding of the most tested areas.

Which is better, ACCA or CFA?

The choice between ACCA and CFA depends on your career goals. If you’re interested in accounting, auditing, and finance management, ACCA is the better option. On the other hand, if you’re focused on investment analysis, portfolio management, or financial markets, CFA is the ideal path